Stanford netted a record $12.1 billion in investment gains over the last year through its Merged Pool, through which most of the endowment is invested in stocks and bonds, according to annual results released on Tuesday.

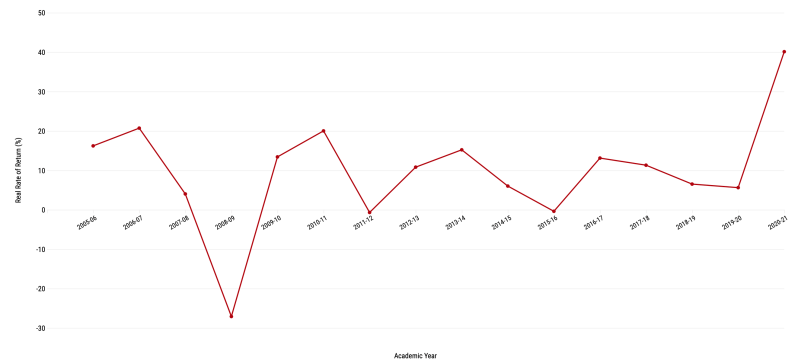

The total value of the University’s endowment — which includes about 75% of the funds from the Merged Pool along with real estate and other holdings — is now $37.8 billion. The 40.1% return on investment marks a significant increase from last year’s 5.6% return and 2019’s 6.5% return, and it comes amid a year of endowment success for many of Stanford’s peer institutions.

The Merged Pool is now worth $41.9 billion. University spokesperson E.J. Miranda called the returns “very reassuring” and cited President Marc Tessier-Lavigne’s comment to Stanford News on Tuesday that the “results have created a tremendous opportunity to advance Stanford’s mission.”

Chief Executive Officer of Stanford Management Company (SMC) Robert Wallace told The Daily that the University’s investment returns over the past year defined a “record year for Stanford, both in terms of the percentage investment increase and the absolute dollar gain.” Data indicate that these returns far surpass those of previous years, especially following slightly decreasing endowment returns from 2016-2020.

The median return on endowment for U.S. colleges and universities this year was 33.4%, according to Stanford News, placing Stanford’s performance 6.7% above the median. Last year’s median return across U.S. institutions was 1.6%. This constitutes a year-over-year increase of 31.8%, indicating that this year was a year of booming returns for many institutions.

Duke University and MIT boasted the most success of Stanford’s peer institutions, with returns of 55.9% and 55.5% over the last year, respectively. Out of the 10 schools charted above, Stanford ranked eighth. Wallace added that Stanford’s returns place the University in the top quartile of all U.S. colleges and universities.

Another set of metrics commonly used to evaluate university endowments is the 5 and 10 year annualized net returns, which average a school’s endowment performance over longer periods of time. Stanford’s 5- and 10-year returns are 14.7% and 10.8%, respectively, which rest well over the nationwide medians of 11.9% and 8.4%, according to Stanford News.

As a result of the endowment’s growth, the Board of Trustees allotted an extra $500 million of the money gained from the endowment for the University’s budget, according to Miranda. This extra funding will supplement the $1.4 billion that was already allotted to the budget from the endowment, a slight increase from last year’s $1.3 billion allotment, to which the University added an extra $379 million to support COVID-19 expenses.

“These funds will be used to support our core academic mission and to accelerate our education, research, affordability, inclusion and outreach activities under our Long-Range Vision,” Tessier-Lavigne told Stanford News.