Every Saturday, a group of volunteers travels from Stanford to Metro Park Library in East Palo Alto to help low-income residents with an unglamorous task: filing their annual federal and state tax returns. Run by Stanford Law School (SLS) students, the program lasts for the whole tax season and is part of the national Volunteer Income Tax Assistance (VITA) initiative.

Law lecturer Michael Winn, who serves as director of the Pro Bono and Externship Program, said he was inspired by students’ leadership skills and their commitment to helping the community.

“Because these pro bono projects put students at the helm of the project, [I] think they better feel the impact and learn more about the organization of pro bono,” Winn said.

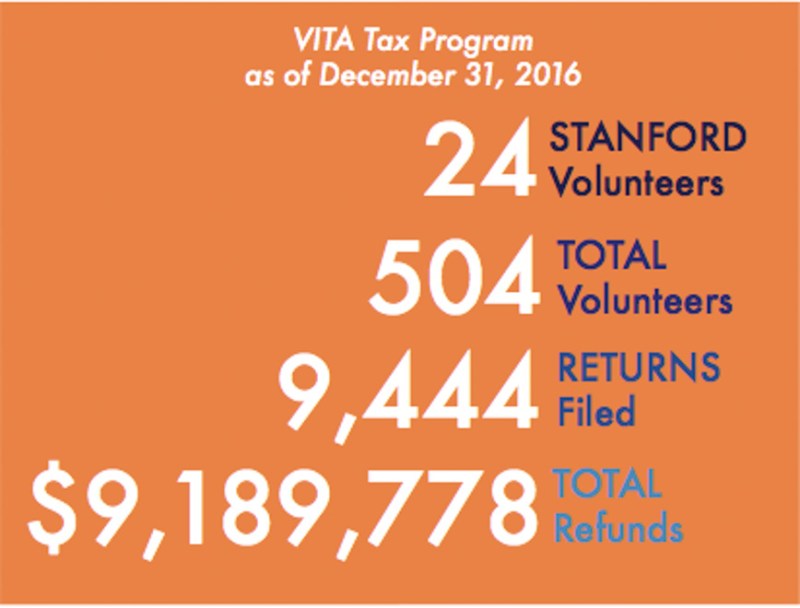

In 2016, the parent VITA program returned an average of $1,000 to each taxpayer who sought help. These taxpayers are usually low-income residents who cannot afford tax assistance and often miss out on significant tax returns as a result.

Although majority of the 24 volunteers are current law students, volunteers are not required to have in-depth knowledge of the law or accounting. Volunteers must take an exam before starting work, but most of the learning comes on the job.

“Volunteers have to understand where information goes, why this doesn’t count as income or why does this person qualify for this tax credit,” said Kelsey Merrick J.D. ’18. “So you really understand the rationale behind your taxes.”

According to program coordinator Carl Hudson J.D. ’17, communication skills are key to the volunteers’ task. Volunteers must be able to explain the complexities of tax law to laypeople, combining a high-level understanding of the complexities of the tax system with an ability to summarize the relevant information for taxpayers concisely.

One common problem that surfaces for clients is the obscurity of certain tax laws. For instance, Uber drivers often do not realize that they need to keep track of the miles that they drive for their tax returns as well as pay a self-employment tax as independent contractors. According to Merrick, the volunteers’ task is to make these complex laws accessible to the average taxpayer.

“I think those interpersonal skills, in terms of figuring out the dynamic and power balance and making sure you’re respecting your client and they know what’s going on, are challenging but important for a lawyer,” Merrick said.

Volunteers from SLS receive pro bono hours for their work at the clinic, which can earn them a distinction status on their degree. However, many volunteers participate because they find purpose in the work, rather than for any immediate reward.

“I started volunteering in D.C. my senior year and continued even after I was working full-time. I really loved it,” said Merrick.

She also noted that the program helps volunteers — including law students like herself — to understand the inner workings of the tax system.

“In addition to helping people because taxes can be complicated, you learn how to do your own taxes, a life skill that, sadly, a lot of people don’t have,” said Merrick. “These are important legal and policy issues that we as citizens and as law students should know.”

Contact Josh Wagner at jwagner4 ‘at’ stanford.edu.